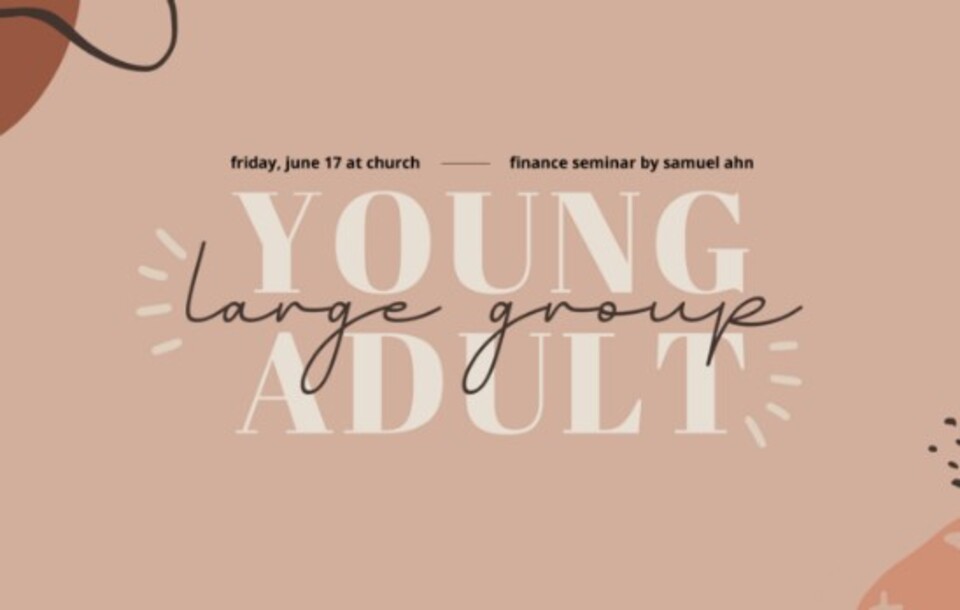

Kairos Church invites young members to join the Finance Seminar this summer to gather in large groups every month on June 17 at 7 p.m.

The church's announcement features Sam Ahn as their guest to speak on a deeper dive into finances. They added that there would be a complimentary dinner for everyone.

Sam Ahn, Finance Advisor

According to the Raymond James website, Ahn has served in the financial industry since 2011. Before joining the Fed Credit Union, he held a financial advisor position with Bank of America Merill Lynch. The website noted that Ahn is proud of always doing what is appropriate for his clients.

They added that he is a Chartered Retirement Planning CounselorSM and an expert in assisting clients in attaining their retirement goals. They also mentioned that he uses a holistic way of financial planning that covers all aspects of his clients' financial lives.

Moreover, Ahn was born and raised in New York City. He was reallocated to California in 2004. They added that he finished his degree at the University of California, San Diego, where they said he met his wife. The advisor is an active member of his church and loves bonding with his family. The website also stated that he loves playing sports and guitar.

Importance of Financial Literacy to Youth

The YFL website revealed practical reasons why young people in 2020 need to be financially literate. They said youth financial literacy is mainly taken for granted. The irony is that in 2020 money impacts almost every part of someone’s life.

They stated that parents who do not teach their teenagers about money could not expect them to handle their money when they become adults.

They added that it is commonly hard to fix bad financial choices, and it takes several years to do so. Educating the youth about money at an early age will give them essential knowledge and skills.

This learning would help them make informed decisions when dealing with their financial concerns, as posted on the website.

Strengthens Them

The website mentioned that the more knowledge young people have about finances, the better equipped they will be. They added that people believe in the saying that “information is power, " which could also be applied to financial literacy.

But, a lack of proper information about money could harm any young individual, as posted on the website.

Besides, a survey says that young adults who never had a proper financial education end up irresponsible adults, specifically on money matters. They said they do not know how to invest or save enough money to buy a house. Most of the time, these young people have low credit scores.

On the other hand, these behaviors contradict those individuals who were taught about financial management while young. The website said such people could make informed money decisions in adulthood because they had a rooted financial foundation in their youth.

More importantly, the website emphasized that young adults would not be easily influenced to join in activities such as gambling and Ponzi schemes if they have an established financial background, as posted on the said website.

More from Crossmaps:

Foothills Christian Church to host Money & Marriage Workshop